What Is Debt Yield in Real Estate Investing? A Critical Metric for Private and Hard Money Loans

If you're a new or mid-level real estate investor, you've likely heard of LTV (Loan-to-Value) and DSCR (Debt Service Coverage Ratio). These are common terms when applying for real estate investment loans, especially from banks or DSCR lenders.

But there's one often-ignored metric that can make or break your deal—especially if you're using private money loans or hard money lenders.

That metric is called Debt Yield.

And if you don’t know what it is, how it works, and why private and hard money lenders rely on it, you might find yourself holding a deal that can’t be refinanced…

Tired of the Lies? Try a Lender Who Tells the Truth.

You’ves seen the ads.

“0% down!”

“Guaranteed funding!”

“Pre-approved in minutes!”

But what they don’t show you is the fine print. The vanishing lenders. The last-minute surprises that leave your flip frozen and your team on hold.

If you’ve ever trusted a lender who overpromised and underdelivered, you’re not alone.

Most of our clients come to us after…

Why AIs Like ChatGPT Make Mistakes (And What You Can Do About It)

AI feels like magic… until it isn’t.

You type a question into ChatGPT, Gemini, or Grok, and like a genie from a bottle, it gives you a perfectly phrased answer with the confidence of a tenured professor. But then…wait a minute…you realize something’s off.

The answer sounds great.

But it’s actually wrong.

Sometimes wildly wrong.

That disconnect isn’t just frustrating. It can be costly, especially if you’re relying on AI tools for business decisions, client-facing content, or operational tasks.

So what’s going on?

How $40,000 Today Can Become Full Retirement in 10 Years

Most Americans aren’t trying to retire rich.

They’re just trying to retire at all, and preferably without moving in with their adult kids.

Let’s be honest. For the average person in their 40s, 50s, or even early 60s, the dream of retiring with millions in the bank is off the table. But here’s the good news:

You don’t need millions.

You just need consistent monthly cash flow that comfortably covers your lifestyle.

That is exactly what smart real estate investing can….

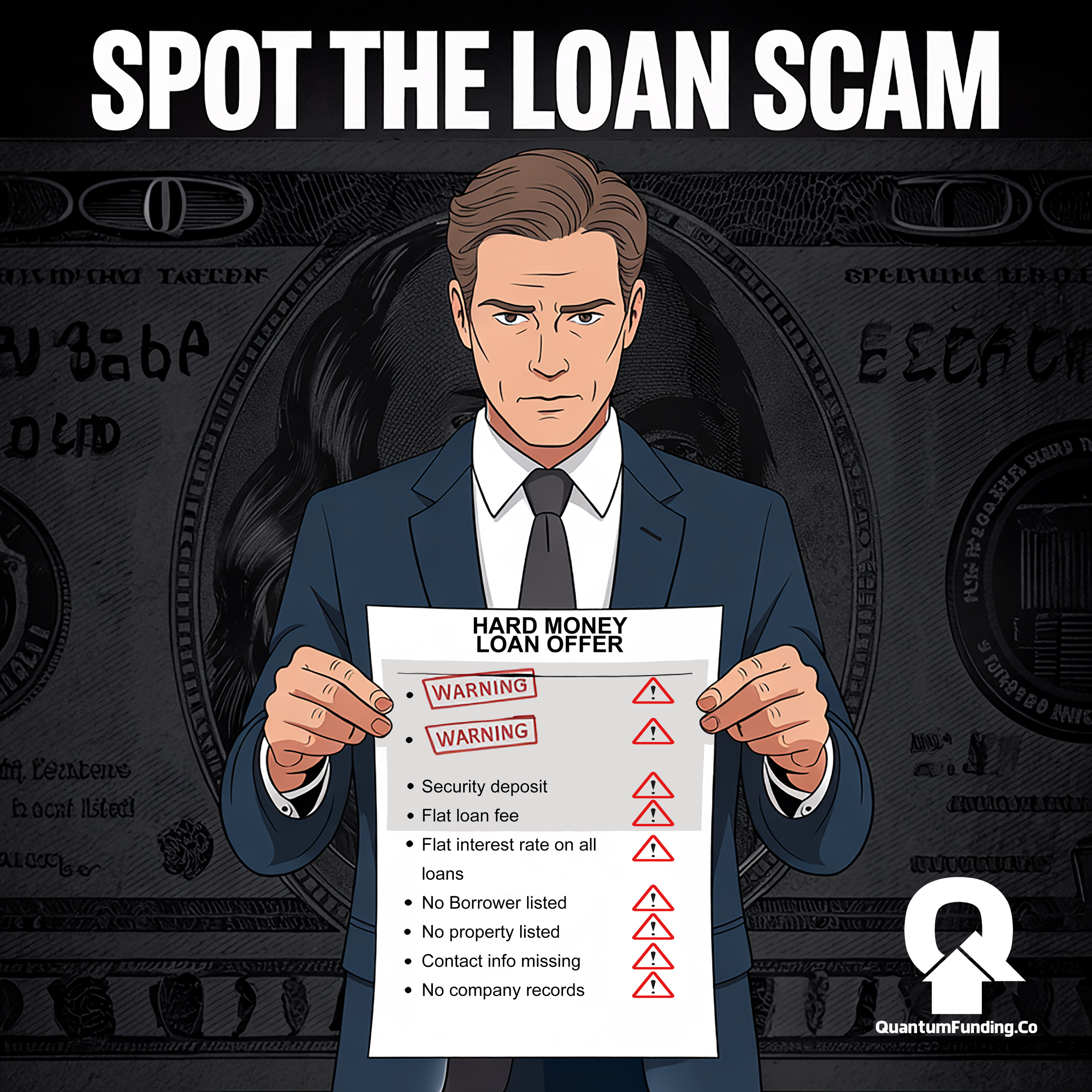

How to Spot a Hard Money Loan Scam

Hard and private money lending can be a valuable tool for real estate investors—but it’s also a magnet for scam artists looking for easy targets. Knowing how to identify red flags can protect you from losing thousands, or worse, your entire deal.

Below, I break this down into two essential parts: first, the core principles for identifying scam loan offers, and second, a real-world case study from an actual loan document I reviewed.

Part 1: Principles for Spotting a Hard Money Loan Scam

Whether you’re new or seasoned in real estate, watch….

10 Markets Where Realtors Can Truly Thrive in 2025 — and Why I’m Only Hiring a Few in Each One

If you’re a real estate agent who wants to serve better clients, earn more consistent income, and stop competing for every scrap in a crowded MLS, then I want to introduce you to something very different and very real.

It’s called the Quantum REI Specialist opportunity, and it comes from my startup: The Quantum Funding Company. We exist to help real estate investors get fast, reliable funding, and we train a select group of Realtors in each market to serve those investors from the front lines.

These trained Realtors are called Quantum REI Specialists, or QRSs for short. They are not loan officers, and they are not asked to fund deals. They simply help Real Estate Investors….

The 3 Biggest REI Challenges: Finding Deals, Funding, and Help

The 3 Biggest REI Challenges: Finding Deals, Funding, and Help (Spoiler Alert: “Help” Is the One That Solves the Other Two)

In nearly every conversation I have with real estate investors, I ask the same question:

“What are the top three challenges you’re facing right now?”

And almost without fail, they give the same three answers:

Finding deals

Finding funding

Finding help

Now, I want to start with the third one, finding help, because I believe it is the most important of the three. Why? Because getting the right kind of help can make finding deals and funding much easier.

When investors say they need help, they are not talking about….

When You’re the Boss… But You’re Also the One Who’s Struggling to Show Up

There’s something nobody tells you when you become your own boss.

It’s not the taxes.

It’s not the systems.

It’s not the risk.

It’s the silence.

The silence when no one’s clapping. The silence when the leads aren’t coming. The silence when you’re working harder than anyone knows, and yet the results…..

Real Estate Investing 101: Creative Use of Subject-To, Land Trusts, and Rehab-Only Loans to Fund Your First Flip

Let’s be real: if you're a first-time house flipper, access to capital is often the biggest roadblock standing between you and your first successful deal.

Banks won’t touch distressed properties. Hard money lenders want large upfront reserves. Private lenders prefer borrowers with experience.

It can feel like an iron wall with no door.

But what if I told you there’s a side entrance?

There’s a combination of strategies that lets new investors sidestep the usual lending gauntlet. It doesn’t require perfect credit, huge cash reserves, or even a loan in your name. The method? A Subject-To acquisition, held in a Land Trust, funded by a rehab-only loan.

Let’s walk through what these tools are, how they work together, and exactly what….

From Rock Bottom to Real Estate: How I Rebuilt My Life One Risk at a Time

People say hitting rock bottom is the worst thing that can happen.

For most people, that’s probably true.

But for a select few, it’s possibly the best thing that could ever happen.

What do I mean?

The worst thing isn’t hitting rock bottom. The worst thing is hitting rock bottom with no hope, no clue, and no drive to climb out of the pit.

That’s exactly where I was not too long ago.

After 33 years as a pastor, I lost virtually everything. The marriage I’d poured myself into for 28 years ended. The career I’d built came to a screeching….

The One Tool I’ll Never Buy Real Estate Without Again

Have you ever see something so simple, so genius, that you smack your own forehead and say, “Why didn’t I think of that?” That was me on a video call with John Siegman, the CEO of a new company called PropertyLens.

John and his co-founder come from the insurance world — the “risk management” side, to be exact — and what they’ve built is what I can only describe as: “CarFax on steroids for Real Estate.”

No fluff. No guesswork. Just hundreds of data points, mined and analyzed by AI, then delivered in a report so comprehensive it’ll make your home inspector feel underdressed.

To prove the power of their software, John walked me through a PropertyLens report for a deal one of my clients is considering: a multifamily apartment complex in….

You Signed WHAT?!

Why Every Real Estate Investor Must Learn to Read a Contract!

Let’s get one thing straight right out of the gate: If you're a real estate investor who blindly signs contracts because you “trust your team,” congratulations! You're the Titanic and your iceberg is made of paper!!!

Too many investors, especially newer ones, make one of the most costly and careless mistakes in the business: they don’t learn how to read contracts.

They skim. They shrug. They sign. And then they wonder what went wrong.

Why do they do this? Because they assume it’s….

The Calm, Profitable Waters Most Realtors Completely Ignore

Right now, there are over 1.6 million Realtors in the U.S. fighting tooth and nail to serve traditional buyers and sellers. Everyone’s posting the same home tour videos, using the same tired taglines like “Your dream home is just one call away,” and cold-calling expired listings like it’s 2007.

It’s like watching a pack of wild piranhas fighting over one chicken in a shrinking pond.

But here’s what no one’s telling you: 20% of all homes….

REI Guide to Overlooked Pockets of Wealth in Texas

Visionary Investors Wanted: What if your next real estate windfall isn’t in Austin’s hip core or Dallas’ glitzy suburbs, but in a humble Texas town quietly booming with growth? Texas is vast and full of surprises – and some of the nation’s fastest-growing cities are under-the-radar Texan towns. In this guide, we’ll shine light on these overlooked pockets of wealth. These are places where cash flow, appreciation, and affordability converge, offering golden opportunities for both the newcomer looking to build steady income and the seasoned investor seeking big upside.

Prepare to venture beyond the obvious. From high-yield….

What Private & Hard Money Lenders Really Want (And How to Give It to Them)

Let’s be honest: borrowing private or hard money for the first time feels a bit like getting hazed by a fraternity. You want in, they’ve got the keys, and you're standing there with your dreams in one hand and your checking account in the other, wondering if you're about to get dunked in the deep end. Spoiler: you are.

But here’s the good news—you only have to take that first hit once.

Whether you're new to real estate investing or you've done a few deals but still feel like a freshman, this post will tell you exactly what lenders are looking for and why they care.

The Six Things PMLs and HMLs Want to See (In Order of Importance)

The Deal Itself – If the numbers don’t make sense, nothing else matters. The property is the collateral. Show the lenders meat on the bone.

Your Experience – Rookie? No shame, but….

Crypto Boom Ignites DFW Real Estate: A Visionary Investor’s Guide

If you’re like me and you’ve been watching what’s happening around Dallas-Fort Worth lately, you know something big is brewing. The DFW metro area has emerged as a major hub for blockchain, crypto, and fintech innovation, drawing in entrepreneurs, startups, and highly skilled workers in droves. Texas’s pro-technology stance is a huge part of this story – in fact….

Embracing Chaos: Build Your REI Empire with Growth, Not Control

Building a real estate investment empire might sound like a glamorous pursuit, full of passive income and endless opportunities to live life on your own terms. However, the reality often involves juggling maintenance calls, tenant issues, and unexpected expenses, which can quickly turn your dream into a daunting full-time job. So, how do you tip the scales back in your favor and keep your business growth-focused without getting bogged down in the daily grind? The key lies in….

Oklahoma City? Why Real Estate Investors Should Strongly Consider OKC

In the world of real estate investing, discovering a hidden gem before it becomes the next “hot market” is the name of the game. That’s exactly what Oklahoma City (OKC) represents right now. As recently spotlighted on The Real Estate Guys Radio Show podcast, OKC is rapidly becoming one of the best and least-known…

Hire a Property Manager Already! Be an REI CEO Instead of a Landlord

Feeling overwhelmed by the daily grind of managing rental properties? You're not alone. Real estate investing can be a rewarding path to passive income and financial independence, but it's easy to lose sight of those goals when you're bogged down with tenant complaints and maintenance calls. Instead of juggling all the responsibilities yourself, consider the transformative power of professional property management. By hiring a property manager, you can delegate tasks that consume your time and energy, allowing you to focus on expanding your portfolio and maximizing returns. Ready to step back from micromanaging and start growing your….

The Unbeatable REI Offer: is There Such a Thing? YES!

I love the Latin word, “Invictus”. The most literal translation of the word into English is “In Victory”. But the more accurate term is unconquerable or unbeatable! You know, like the Dallas Cowboys! Okay, that’s wishful thinking on my part. But I do have a point: when you’re in the thick of a competitive real estate market, your offer has to be unbeatable!! Remember, your offer letter isn’t just paperwork—it’s your chance to shine. And if you’re working with private money, you already know that being “Pre-approved” is off the table. That’s where an unbeatable offer letter comes in—a document that tells the seller, “I’m serious, I’m funded, and I’m ready to close, no ifs or buts.”

In this post, we’re breaking down what makes an offer letter truly unbeatable….