How to Spot a Hard Money Loan Scam

Hard and private money lending can be a valuable tool for real estate investors—but it’s also a magnet for scam artists looking for easy targets. Knowing how to identify red flags can protect you from losing thousands, or worse, your entire deal.

Below, I break this down into two essential parts: first, the core principles for identifying scam loan offers, and second, a real-world case study from an actual loan document I reviewed.

Part 1: Principles for Spotting a Hard Money Loan Scam

Whether you’re new or seasoned in real estate, watch for these warning signs—they should make you pause, ask hard questions, and possibly walk away:

Upfront Fees Before Funding

Legitimate lenders may charge minor costs—like appraisal or application fees—but they do not demand large “security deposits” before approval or funding.Refund Promises That Sound Too Good to Be True

Scammers love dangling the “refundable” carrot—but often keep you in “conditional approval” limbo, avoiding refunds altogether.One‑Size‑Fits‑All Interest Rates

Real hard money rates vary by borrower risk, property type, and loan structure. Flat rates across all loans are unrealistic—and suspicious.Unusually High Origination Fees

True hard money lenders typically charge 2–3%. Anything approaching 5% or more needs serious justification.Missing Key Loan Metrics

Legitimate offers outline ARV (After Repair Value), LTV (Loan-to-Value), LTC (Loan-to-Cost), closing costs, and the borrower’s required cash to close. Missing those? You’re looking at a mystery deal.No Borrower or Property Details Provided

A genuine loan offer states who is borrowing and where the property is. If you're given nothing, it's a serious red flag.Vague or Incomplete Contact Info

Pay attention to contact details—if the phone number is missing digits or the address lacks a city or specificity, that’s a sign something’s off.No Clear, Vetted Track Record

Trustworthy lenders can show verifiable past deals, have transparent licensing (if required), and solid references.

Part 2: Case Study – A Loan Offer That Raised Red Flags

A borrower recently forwarded me a loan offer from a lender called 141 Funding LLC. This was outside my vetted lending network—and here’s everything that raised serious red flags:

3.5% Security Deposit Upfront

Claimed as “refundable,” but held until loan payoff. Reputable lenders secure loans with property liens—not cash deposits.5% Origination Fee

Nearly double the industry standard of 2–3%—yet offering no added value.Flat 5% Interest Rate on All Loan Types

The same rate applied to personal, business, construction, and real estate loans. Unrealistic and suspicious.No ARV, LTV, or LTC Details

No numbers listed. You can’t assess risk or value—so why proceed?Fees Due Before Funding

Major fees required upfront, not at closing—a classic scam structure.No Borrower or Property Mentioned

The document doesn’t identify who’s applying or which property is on the line. That should never happen.Vague Location Info—Just “NY”

The address simply shows "NY"—no city, no zip code. Not how professional lenders operate.Incomplete Phone Number

They list a cell number as (315) 372-130—missing a digit. Unprofessional, and downright sloppy.

Who is 141 Funding LLC?

I looked into the company through publicly available records:

Yes, 141 Funding LLC is officially registered in New York as of March 29, 2023, and is listed as active under document number 6778131. Their registered address is 141 5th Ave, 2nd Floor, New York, NY 10010 according to state records bizprofile.net+2instagram.com+2bbb.org+4reddit.com+4trustpilot.com+4trustpilot.com.

However—there’s no verifiable web presence or credible online information linking this entity to legitimate hard money lending operations. There are zero reviews, no licensing proof, no real testimonials, and no transparent terms on a public website.

Bottom Line

This loan offer ticks all the boxes for a scam:

Unbelievable fees and deposits

No transparency on borrower, property, or risk metrics

Missing or sloppy contact info

No public evidence of legitimacy—despite being registered

If you'd like to examine the original document yourself, you can download it here.

Hard money lending works—but only when you're dealing with honest, transparent lenders. Learn the red flags, ask tough questions, and don’t let a “too-good-to-be-true” offer become your worst mistake.

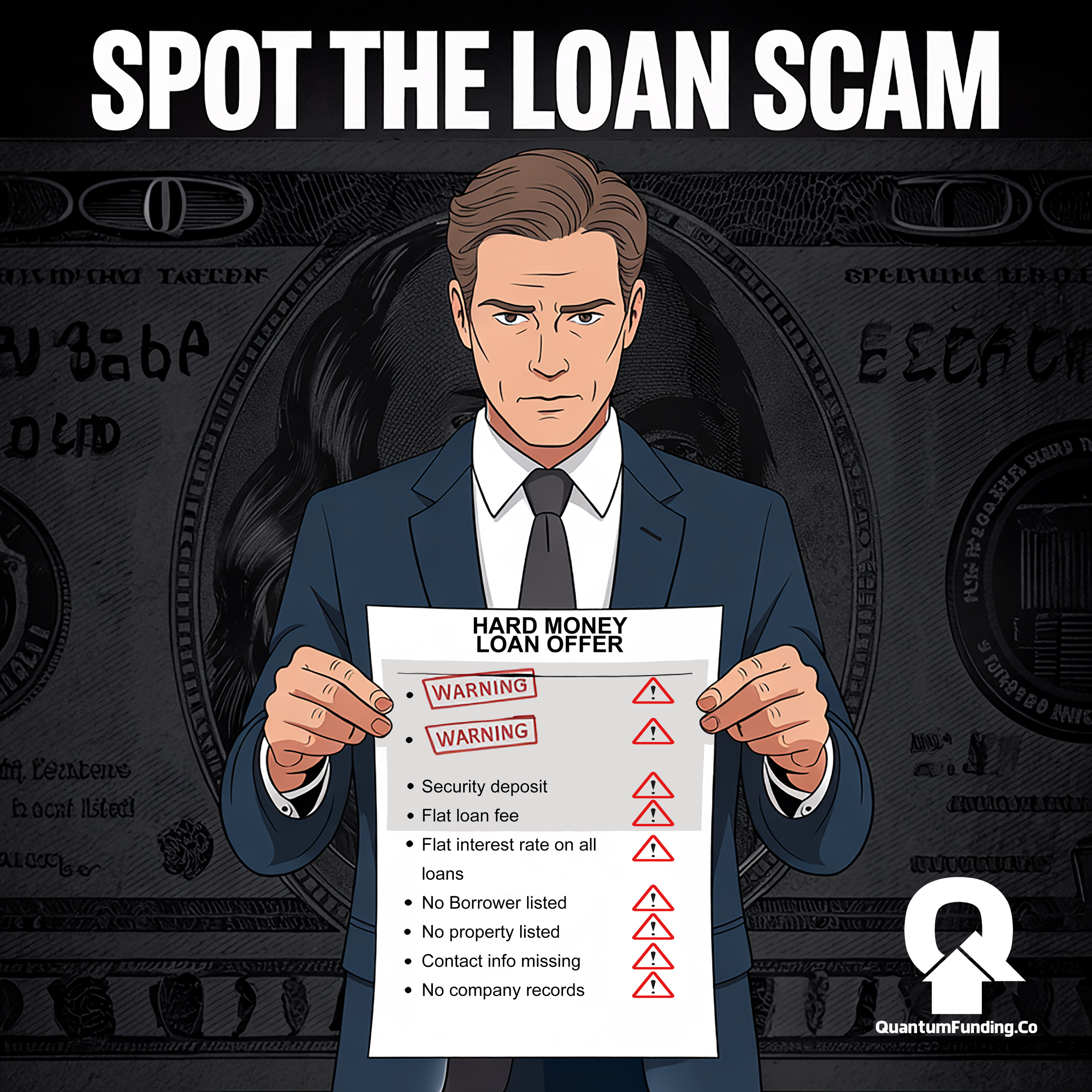

Below is an infographic image you can save to remind you of these points down the road.